College Football BCS Rankings v. Car Insurance Rates (Infographic, Part 2)

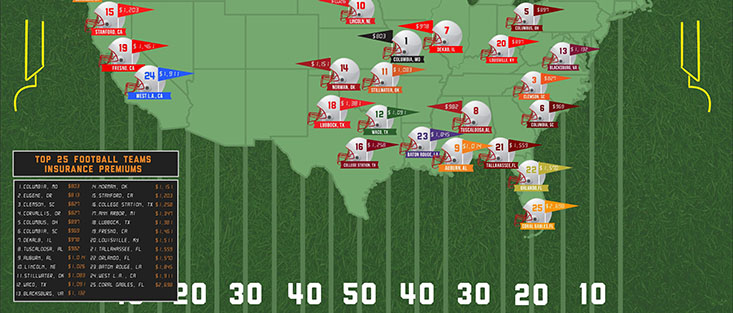

National auto and home insurance agency, Answer Financial® Inc., compares auto insurance quote data for the top 25 college football cities to bring you our rankings for lowest and highest car insurance prices.

Encino, CA; October 24, 2013 Last week we announced our own ranking of the Associated Press (AP) Top 25 Poll of college football teams by the price these college towns pay for car insurance. Now that the Bowl Championship Series (BCS) standings have been released, Answer Financial Inc. is following up to check the score on these top-ranked teams and their estimated insurance rates.*

With five undefeated teams leading the pack and gearing up for Saturday home games, things are looking good for these Bowl Championship contenders. Interesting to note is that three of these teams were also in our top five for lowest car insurance rates: the Missouri Tigers, the Oregon Ducks and the Ohio State Buckeyes.

Rounding out the top five for lowest car insurance are the Clemson Tigers and the Oregon State Beavers, but they’re ranked 9th and 25th respectively when it comes to the BCS. These teams may be long shots for the Bowl Championship, but it’s “Game on!” for the lead among our lowest insurance rates.

Alabama is 7-0 and holding strong as the number one ranked NCAA football team, but the Crimson Tide’s perfect season and vaunted defense hasn’t helped them when it comes to car insurance rates, where they currently come in 8th place on our list of lowest car insurance premiums.

Are the Florida State Seminoles the team that can finally supplant the Tide from the #1 spot? Maybe in terms of football, but when it comes to car insurance premiums, the Seminoles take our 21st spot. Florida in general did not fare well in our rankings as the UCF Knights and the Miami Hurricanes also ranked in our bottom five.

Where does your alma mater fall on our list below? If you’re paying too much for auto insurance, call Answer Financial, the leading insurance shopping engine, at 1-866-635-7777 to compare rates and save, or check rates online at www.AnswerFinancial.com. Answer Financial has partnered with more than 20 insurance companies to offer a great selection and better prices, all in one place.

| Insurance Rank | Football Rank (AP) | College | Team | City | Average Rate |

|---|---|---|---|---|---|

| 01 | 05 | University of Missouri | Tigers | Columbia, MO | $ 803 |

| 02 | 03 | University of Oregon | Ducks | Eugene, OR | $ 813 |

| 03 | 09 | Clemson University | Tigers | Clemson, SC | $ 827 |

| 04 | 25 | Oregon State University | Beavers | Corvallis, OR | $ 827 |

| 05 | 04 | Ohio State University | Buckeyes | Columbus, OH | $ 897 |

| 06 | 21 | University of S. Carolina | Gamecocks | Columbia, SC | $ 969 |

| 07 | 18 | Northern Illinois University | Huskies | DeKalb?, IL | $ 978 |

| 08 | 01 | University of Alabama | Crimson Tide | Tuscaloosa, AL | $ 982 |

| 09 | 11 | Auburn University | Tigers | Auburn, AL | $ 1,014 |

| 10 | 24 | University of Nebraska | Cornhuskers | Lincoln, NE | $ 1,026 |

| 11 | 19 | Oklahoma State | Cowboys | Stillwater, OK | $ 1,083 |

| 12 | 08 | Baylor | Bears | Waco, TX | $ 1,091 |

| 13 | 14 | Virginia Tech | Hokies | Blacksburg, VA | $ 1,132 |

| 14 | 15 | University of Oklahoma | Sooners | Norman, OK | $ 1,151 |

| 15 | 06 | Stanford | Cardinals | Stanford, CA | $ 1,203 |

| 16 | 16 | Texas A&M | Aggies | College Station, TX | $ 1,258 |

| 17 | 22 | University of Michigan | Wolverines | Ann Arbor, MI | $ 1,347 |

| 18 | 10 | Texas Tech | Red Raiders | Lubbock, TX | $ 1,381 |

| 19 | 17 | California State University, Fresno | Bulldogs | Fresno, CA | $ 1,461 |

| 20 | 20 | University of Louisville | Cardinals | Louisville, KY | $ 1,511 |

| 21 | 02 | Florida State University | Seminoes | Tallahassee, FL | $ 1,559 |

| 22 | 23 | University of Central Florida | Knights | Orlando, FL | $ 1,570 |

| 23 | 13 | Louisiana State University | Tigers | Baton Rouge, LA | $ 1,845 |

| 24 | 12 | University of California, LA | Bruins | West Los Angeles, CA | $ 1,911 |

| 25 | 07 | University of Miami | Hurricanes | Coral Gables, FL | $ 2,698 |

* Data provided is the average insurance rates quoted for males, age 25-29, living in one of the “top 25” college towns based on the October 20th Bowl Championship Series (BCS) Standings.

About Answer Financial® Inc.

Answer Financial, through its agencies Insurance Answer Center and Right Answer Insurance, is one of the largest independent personal lines agency operations in the nation, providing auto and home insurance policies directly to consumers and through a broad network of marketing partners. Answer Financial serves the growing segment of self-directed consumers searching for the best way to save money on insurance by providing one easy place to Shop, Compare, and Buy Insurance. By leveraging technology and partnerships with top-rated insurers including sister company, Esurance, Answer Financial can provide real-time comparison rates for virtually every consumer. Customers can purchase online or over the phone with the guidance of an insurance expert. www.AnswerFinancial.com